With this agreement my dream to create a major global player in the eyewear industry, fully integrated and excellent in all its parts, comes finally true. – Leonardo Del Vecchio, Chairman of Delfin and Executive Chairman of Luxottica Group

French EuroSTOXX50 Lens company Essilor and Italian company Luxottica (RayBan, Oakley) are planing to merger. The news from the source (Essilor)

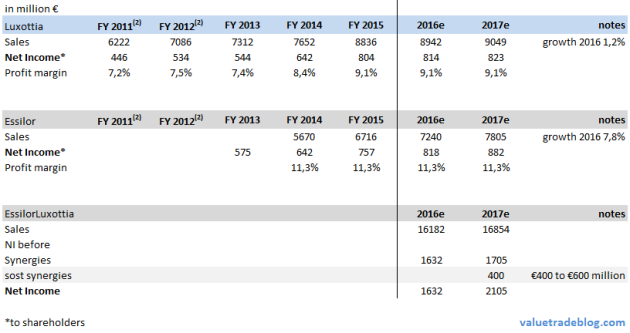

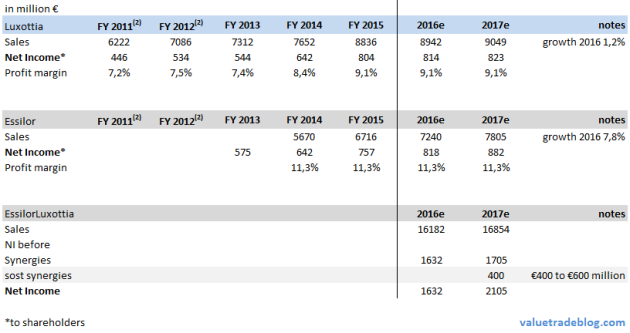

Together, Luxottica and Essilor would have, based on the companies’ 2015 results, the posted combined net revenues of more than €15 billion and combined net EBITDA of approximately €3.5 billion. Based on a preliminary analysis, the combined group is expected to progressively generate revenue and cost synergies ranging from €400 million to €600 million in the medium term and accelerating over the long term.

Luxottica’s Executive Chairman, Leonardo Del Vecchio, would serve as Executive Chairman and CEO of EssilorLuxottica. Delfin – the Luxembourg based holding company of the Del Vecchio Family – would own between 31% and 38% of the shares of EssilorLuxottica so they cleary have “skin in the game”.

Closing expected in H2 2017. The new company name will be EssilorLuxottica.

Quick and dirty valuation of EssilorLuxottica

Both companies look high quality to me so lets look what both of them could look like

I assumed growth rates like in 2016 and cost synergies in the lower range.

Essilor has a market cap. of 24.7 bn €

Luxottia have a market cap. of 26.1 bn €

That would be 50.8 bn € combined (if it would be that easy)

With an assumed Net Income of 2.1 bn in 2017 that would be a PE-ratio of ~24 not that cheap.

The transaction looks quite complicated:

The transaction would entail a strategic combination of Essilor’s and Luxottica’s businesses consisting of (i) Delfin contributing its entire stake in Luxottica (approx. 62%) to Essilor in return for newly-issued Essilor shares to be approved by the Essilor shareholders meeting, on the basis of the Exchange Ratio of 0.461 Essilor shares for 1 Luxottica share, and (ii) Essilor subsequently making a mandatory public exchange offer, in accordance with the provisions of Italian Law, to acquire all of the remaining issued and outstanding shares of Luxottica pursuant to the same Exchange Ratio and with a view to delist Luxottica’s shares.

I will look at it tomorow again, maybe there is some trick in it?

Sources:

Luxottia

Luxottia multi year numbers

Essilor

Essilor Invetors page

Essilor 2015 Results