Note: Because of the actuality of the topic I will post an unfinished article. I apologise for that. The new shares will start trading today.

Monthly Archives: May 2016

Some links and a game

The “BetterInvesting Magazine” Releases July Stock to Study and Undervalued Stock Choices for Investors’ Informational and Educational Use. They liked Foot Locker and Stericycle. (link)

Tim McAleenan Jr.wrote about what to think about Bayer’s $62 billion all-cash offer for Monsanto (link)

The $122 per share offer, despite being a 37% premium compared to Monsanto’s May 9th closing price, still represents an attractive takeover point for Bayer.

Tim McAleenan Jr. likes Sherwin Williams (link)

A nice collection of Charlie Munger Quotes (link)

Someone will always be getting richer faster than you. This is not a tragedy.

Dividend Growth Investor likes Target Corporation (link)

Bloombergs “The Trading Game”. At the end it shows you which stock you were trading. Don’t know if this means to deter people from Daytrading and Chart Analysis but I lost a lot of money. Feel free to post your score as comment. (link)

Investor AB part 3: Alternatives

When I was looking at Investor AB, the Wallenbergs and the Swedish Investment landscape in general, I came across some other interesting Investing-companies. In this article I want to present you a first overview about two names that often pop up. Lundbergföretagen and Industrivärden. Fortunately “don’t invest in companies with names you can’t pronounce” is not a general investment rule.

Lundbergföretagen AB (real estate and stocks)

Latest net asset value February 23 2016: SEK 444/share

B share = 11.05.2016 SEK 443,75/share (no upside to NAV, now the shares trade even higher)

Lundbergs is an investment company that manages and develops a number of companies by being an active, long-term owner. The company was found in the year 1944 and was engaged in construction operations in its early years. Then they moved to investing – first into properties, later in publicly listed companies.

Bayer AG / Monsanto

The german chemical and pharmaceutical company Bayer want’s to buy U.S. agrochemical company Monsanto (link: press release Bayer)

Bayer has made an all-cash offer to acquire all of the issued and outstanding shares of common stock of Monsanto Company for USD 122 per share or an aggregate value of USD 62 billion

Note: The shares are trading at around 110 $, this still would be an upside of roughly 10% now – looks like the market sees some uncertainties. I see the undisturbed price for Monsanto at around 90 – 95$.

Monsanto rejects $62B Bayer bid, but still is open to talks (link)

Monsanto shares closed regular trading up 3.1 percent at $109.30 and gained another 1.5 percent in after-hours trading, rising to $111.

Meanwhile:

That could be a problem, with some saying Bayer’s proposal, at 15.8 times Monsanto’s earnings before interest, tax, depreciation and amortisation (EBITDA) for the year ended Feb. 29, is already a stretch for the German company.

Let’s take a look at what Bayer is planning to pay for 62 bn

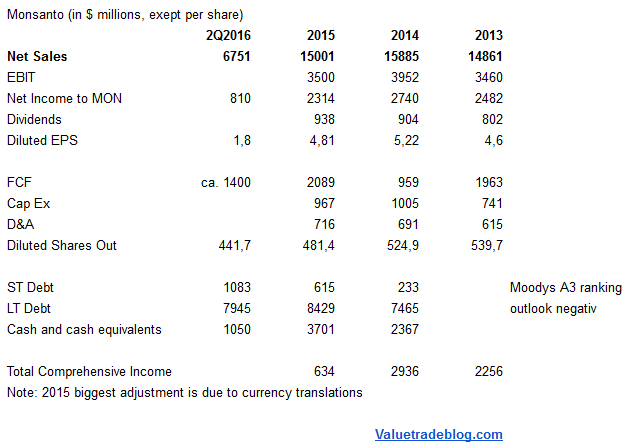

I looked at Monsantos 2015 annual report, which besides some nice photos of families marvel at corn presents us this numbers: (link)

Their 2024 Bond yields 3.24% (link morningstar)

From the 2Q2016 report (link)

Monsanto updated its fiscal year 2016 as-reported EPS guidance to be in the range of $3.72 to $4.48 per share, primarily due to a change in the expected timing for the accounting of restructuring expense. The company confirmed ongoing EPS guidance in the range of $4.40 to $5.10 per share.

Let’s be optimistic and assume that they can reach the $5.10 per share. At a price of 122 USD this would be a PE-ratio of 23.9 – not that cheap.

Bottom Line:

Like in mostly M&A activities this is an interesting case with some uncertainties and some chances. I don’t have deeper insight into this one but I will follow this from the sideline and hopefully will learn something from it. I’m planing to look at Bayer next.

Disclaimer: The content contained on this site represents only the opinions of its author(s). I may hold a position in securities mentioned on this site. In no way should anything on this website be considered investment advice and should never be relied on in making an investment decision. As always please do your own research!

Investor AB – the swedish Berkshire Hathaway

Investor AB is a swedish owner of high-quality, international companies founded by the Wallenberg family a hundred years ago. Basically it is a business conglomerate with listed investments, wholly-owned subsidiaries, Privat-Equity and Financial Investments. I have written already about them (here). Lets look at some of their biggest holdings to get a feeling for what Investor AB is all about:

Atlas Copco, about 15% of NAV: Provides compressors, vacuum and air treatment systems, construction and mining equipment, power tools and assembly systems.

SEB, about 14% of NAV: The “birthplace” of Investor AB. A financial services group with the main focus on the Nordic countries, Germany and the Baltics.

ABB, about 12% of NAV: Provides power and automation technologies to utility and industry customers. I see similarities to Siemens or General Electric with a sprinkle of KUKA

AstraZeneca, about 10% of NAV: A global, innovation-driven biopharmaceutical company.

Mölnlycke Health Care, about 7% of NAV – biggest not listed Company: Provides single-use surgical and wound care products for customers, healthcare professionals and patients

They introduce all of their holdings and subsidiaries very well and present them in a nice and clear way (like shown below) in their annual report. Their holdings are mostly “down to earth”-Industrials like Atlas Copco, ABB, Saab and Husqvarna, Techs like Ericsson and Health Care companies like AstraZeneca, Sobi or Mölnlycke. And of course swedish Bank SEB and a well known Company called NASDAQ.

Valuation:

In the Interim Report Q1-2016 they write:

Net asset value amounted to SEK 262,282 m. (SEK 344 per share) on March 31, 2016, a decrease of SEK 9,519 m. (SEK 13 per share) during the quarter, corresponding to a change of -4 percent. Over the past 20 years, annual average net asset value growth, with dividend added back, has been 9 percent.

The stock price of the B-class share was at that time (pre dividend) around 286 SEK. That is an upside of around 20% (note: this data is before dividend payout). This is how they list their Holdings in the 1Q16 report and display their reportet value:

| Reportet value SEK bn | EBITDA 2015 SEK bn | Notes | |

| Listed Core Investments | |||

| Atlas Copco -A | 42,1 | ||

| ABB | 36,7 | ||

| SEB -A | 35,3 | ||

| AstraZeneca | 23,7 | ||

| Ericsson | 13,9 | ||

| Wärtsilä | 12,4 | ||

| Sobi | 12,2 | ||

| Nasdaq | 10,4 | ||

| Electrolux | 10,2 | ||

| Saab | 9,1 | ||

| Husqvarna | 5,7 | ||

| Privat Equity | |||

| EQT | 11,9 | ||

| Patricia Industries | |||

| Mölnlycke Health Care | 22,9 | 0,370 | |

| Permobil | 4,0 | 0,540 | |

| Aleris | 3,8 | 0,490 | |

| BraunAbility | 2,7 | 0,030 | |

| Vectura | 1,8 | 0,092 | |

| Grand Group | 0,2 | 0,041 | |

| 3 Scandinavia | 5,5 | 2,92 | |

| Financial Investments | 10,7 | ||

| Gross debt | -32,8 | ||

| Gross cash | 22,0 | <———— | before dividend |

| Net Asset Value Investor AB |

264,4 |

What is interesting is their value assumption of Mölnlycke Health Care. The company has smaller EBITDA and Sales than Permobil and Aleris but is valued much higher. I will have to dig deeper into that.

This is what they write in the 1Q16 report about that:

Quite often, we get questions about the valuation of our wholly-owned subsidiaries. We focus on the intrinsic value and try to grow this long term through industrial value creation. However, we have chosen to report our subsidiaries at book value. Acknowledging that this may not be the perfect way, we have yet to come up with a better alternative. While we have our own view of the intrinsic values, that is just one view.

Maybe its because of much better growth opportunities at Mölnlycke. What I like about their wholly-owned subsidiaries in general is their Health Care focus.

Capital allocation and performance:

Core Investments: During the quarter, we added modestly to our holding inAtlas Copco, as we found the valuation attractive

Financial Investments: Exits were made in Constant Contact, Liba, Nilörn, Transcend Medical and Yuan Chuan. Parts of the holdings in Healthline and Tobii were divested.

On October 30, 2015, Patricia Industries, a division within Investor AB, acquired 95 percent of the U.S. family-owned company BraunAbility. The consideration amounted to SEK 2,820 m. and was paid in cash.

They constantly buy and sell shares and smaller holdings, but the big holdings change rarely – mostly they add to them. As I already mentioned, they owned Atlas Copco for more than 100 years, last quarter they added to their holding.

They have outperformed their benchmark in the long run – remember, other like Berkshire they pay dividends.

It is clearly not an “moonshooting” outperformance but it is based on a solid and sound foundation and I think they will perform at least reasonable from a business perspective. I think the DNA of the holdings has built in some resilience and can weather a storm.

The dividend of Investor AB doubled from 5 SEK in 2010 to 10 SEK for 2015. The stock currently yields (at 277SEK) about 3,6%. This is what they write about their dividend policy:

Our dividend policy is to distribute a large percentage of the dividends received from the listed core investments, as well as to make a distribution from other net assets corresponding to a yield in line with the equity market. The goal is also to pay a steadily rising dividend.

Bottom Line:

There is a lot to like about Investor AB: Their rich history of value investing which even exceeds Warren Buffetts, their “down to earth”-approach, the diversity of their holdings, the long-term horizon of the management, the low-key public profile and fair behavior (low salary) of the owner family, the stock price under NAV, the dividend growth and yield.

For me Investor AB represents a good opportunity to diversify my portfolio and shift away from my US Dollar concentration.

Disclaimer: The content contained on this site represents only the opinions of its author(s). I may hold a position in securities mentioned on this site. In no way should anything on this website be considered investment advice and should never be relied on in making an investment decision. As always please do your own research!

Some links and an interesting graph

Must Read: Very interesting analysis of Berkshire Hathaway (link here)

Stocks with low earnings volatility per unit of growth (aka who has the most stable earnings growth?)

Make sure you read this analysis from valueandopportunity.com about a company that pays 5,7% dividend and has a 10 Year Avg. ROE +22,8%. (link)

Detailed analysis about a common topic: “Do Investors Trade Too Much?”

Very interesting graph from Statista about the music industry:

You will find more statistics at Statista

They say that the whole global music industry generates $ 15 bn in sales. To take this in a perspective: Cisco is planing to buy back stock of that amount. Considering the share of mind music have in our lives, I see this as an enormously tiny number.

North American Railroad Industry

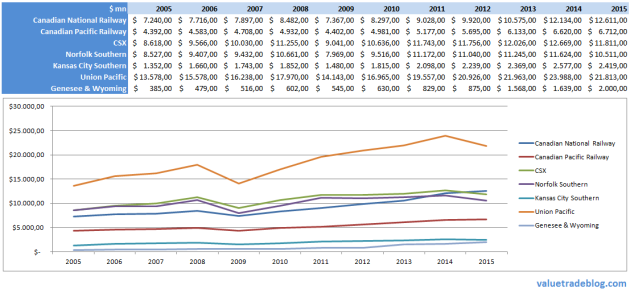

As ambertreeleaves wrote in the comment section on this homepage: “Do you have a view on their dividend payments and the outlook for this? It would be a great diversification for me” I took a closer look at the industry.

First overview about the Industry:

You can find an overview of North American Class I Railroads and were they operate (here).

First I looked at dripinvesting.org how the companies performed from a dividend perspective. Three Railroad companies are ranked as “Dividend Contender” one is ranked as “Dividend Challenger”.

Dividend Contenders 10-24 Straight Years Higher Dividends

| Canadian National Railway | CNI | Railroad | 19 |

| CSX Corp. | CSX | Railroad | 11 |

| Norfolk Southern | NSC | Railroad | 14 |

Dividend Challengers 5-9 Straight Years Higher Dividends

| Union Pacific | UNP | Railroad | 9 |

(the last number shows the straight years of higher dividends so for example 19 years at Canadian National)

Genesee & Wyoming, the company that have risen sales so much pays no dividend.If you want to learn more about Genesee & Wyoming you can find their Investor Relations Homepage (here).

Then I played around with some numbers to get a better overview of how the companies have performed in the near past. Union Pacific and Canadian National performed best – they rose Sales and Earnings. Norfolk’s and CSX’s numbers basically were flat. All of them have bought back around 10% of their shares in the last 5 years.

I guess the good performance of CNI (highest sales growth) to some extend due to currency tailwind. They report in CAD but have some USD revenues. Graph from their Investor Presentation:

Railroad Industry in general:

I find the Railroad Industry very interesting. All of them have reported lower numbers in the last quarter. As known they have some problems with coal sales today – higher energy prices in general are good for railroads.

I think the Railroad Industry will most likely perform like the whole American Industry, I don’t expect a big outperformance. As Warren Buffett said about BNSF:

Most important of all, however, it’s an all-in wager on the economic future of the United States, I love these bets.

Warren Buffett, BNSF and its “Twin”:

The original Berkshire Hathaway acquires BNSF news release from the source (link)

Based on the number of outstanding BNI shares (including shares currently owned by Berkshire) on Nov. 2, 2009, the transaction is valued at approximately $44 billion, including $10 billion of outstanding BNSF debt, making it the largest acquisition in Berkshire Hathaway history.

Article on dealbook (here)

The deal, which including Berkshire’s previous investment and the assumption of $10 billion in Burlington Northern debt brings the total value to $44 billion

Article on Bloomberg about Berkshire and BNSF (here)

The railroad had sent more than $15 billion in dividends to Berkshire through Sept. 30, according to quarterly regulatory filings, …

Union Pacific is very comparable to Burlington Norther. They both operate in the Western USA and have pretty similar size and numbers (to some extend). Union Pacific is now selling for about 69B Market Cap and 82B in EV, about double as much as Warren Buffett paid for BNSF.Union Pacific rose sales around 12% and earnings 45% in the last 5 years.

Photo: Union Pacific Engine from Liji Jinaraj under CC.

Bottom Line:

Canadian National Railway looks like an interesting company to me. I will look at them and Union Pacific later. I don’t think I will find an undervaluation now. I hope I could help you ambertreeleaves. If you guys have a good idea for another sector or company analysis let me know.

Foot Locker 1Q16 Earnings

You can find the Foot Locker first quarter results (here)

From the report, as they highlighted:

- Net Income of $191 Million, an All-Time High for the Company

- 25th Consecutive Quarter of Sales and Profit Increases

- Earnings Per Share of $1.39, an 8 Percent Increase

- Comparable-Store Sales Increase of 2.9 Percent

We produced the most profitable quarter in the Company’s long history, an accomplishment of which everyone at Foot Locker, Inc. should be very proud

Sounds not so bad you think, still the stock is losing around 6% today. The key word here is “rose less than analysts were expecting“. It seems it’s the same with Ross Store (ROST), they are also down today although profit for the quarter was better than projected.

As Peter Schacknow on CNBC.com writes:

The athletic footwear and apparel retailer matched estimates with first-quarter profit of $1.39 per share. Revenue was slightly below analysts’ expectations, and the comparable-store sales increase of 2.9 percent was below consensus estimates of a 4.5 percent jump.

I don’t see this as a tragedy. How can they match estimates, almost match revenue and miss so much on CSS anyway? Foot Locker is defiantly one of the stronger retailers.

To give you a perspective how bad some other names in retail industry performed:

- Kohl’s Corporation for example had an (3.7)% and -3,9% in same store sales

- Macys in 1Q16 had to report a decrease of 7.4 percent in sales, comparable sales were down by 5.6 percent

I think the best thing an Investor can do about this is looking at the business and ignore Mr. Market. If the business do well the stock will follow.

Foot Locker now trades at a Forward PE of 12,3 (gurufocus) and a dividend yield of 1,75%.

Fun with numbers: US Railroads

Some (almost) uncommented fun with numbers.

Revenues of US Railroads in USDmn:

Genesee & Wyoming: from $ 385 mn in 2005 to $ 2,000 mn ten years later

Hormel Foods 2Q 2016

Hormel Foods Corporation is an American food company based in Austin, Minnesota. Hormel sells food under many brands, including the Chi-Chi’s, Dinty Moore, Farmer John, Herdez, Muscle Milk, Jennie-O and many more.

From the Hormel Foods 2Q 2016 report

The company reported fiscal 2016 second quarter record net earnings of $215.4 million, up 20 percent from net earnings of $180.2 million last year. Diluted earnings per share for the quarter were $0.40, up 21 percent from $0.33 last year. Sales for the quarter were $2.3 billion, up 1 percent from last year.

The stock lost about 8,5% on that news – wall street is a crazy planet.

I played around with some numbers. I am calculating with an EPS of 2,11 US$ for 2020 which is a very conservative assumption. Considering a PE-ratio of 16 (decreasing ratio, this could be wrong) in the future the stock would sell at 33,76 US$ in year 2020 – which is lower than now.

Effective May 16, 2016, the company paid its 351st consecutive quarterly dividend, at the annual rate of $0.58.

At 35,48 USD for the share the dividend yield is at 1,6%

Hormel Foods is without questions a high-quality business but for me it is selling at a to high price, even after the drop yesterday.