In the past few weeks Hormel Foods shares had lost about 15% from its 52W-high. I took this as a reason to take a closer look at the company.

Hormel Foods Corporation is an American food company based in Austin, Minnesota. The company was founded in 1891 so they will celebrate their 125th anniversary in 2016.

Hormel sells food under many brands, including the Chi-Chi’s, Dinty Moore, Farmer John, Herdez, Muscle Milk, Jennie-O, Lloyd’s,Skippy, Spam, La Victoria and Stagg brands, as well as under its own name. Hormel has a lot of nr. 1 and nr.2 brands.

Today they announced, that they will sell Diamond Crystal Brands (link)

So they are a non-durable consumer goods company, which usual are boring, unexciting, unsexy but steady, we will see if that is the point with Hormel. By the way I like boring, unexciting and steady companies.

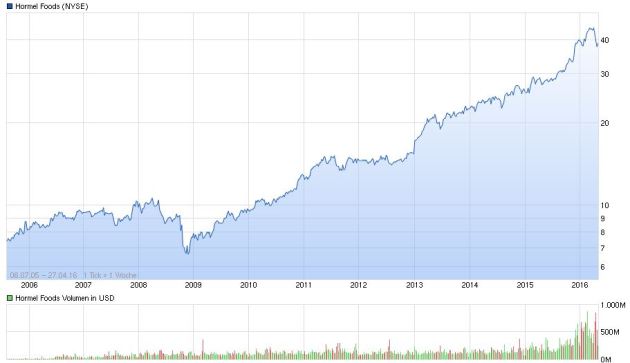

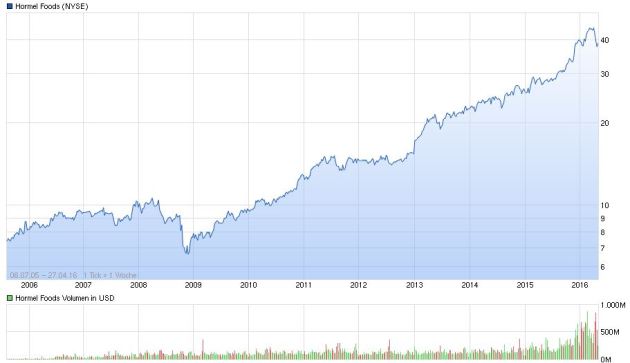

The long-term chart looks impressive

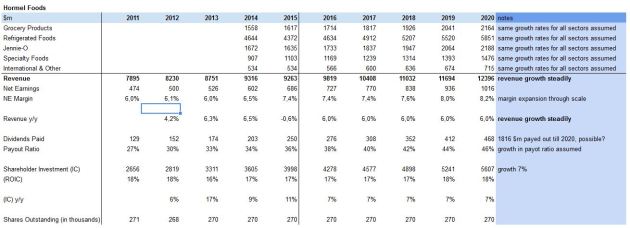

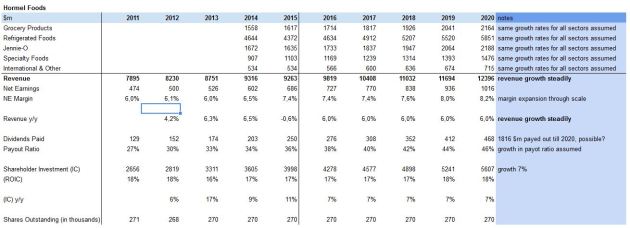

I worked on a small model for Hormel to get a better feeling of how the company is going to do and how much the whole company is worth.

some notes to the model:

As always this are just some assumptions I made, this could be right or not.

- from 2011 to 2015 they grew their revenue from 7895 to 9263 million dollar.

- from 2011 to 2015 they grew their net earnings from 474 to 686 million dollar.

- I assumed a steady revenue growth of 6% till 2020.

- I assumed a margin expansion from 7,4% today – to 8,2% in 2020 due to scale effects, I am interested to see how this will play out.

- this translates in 1016 million dollar net earnings in 2020, we will see

- no share buybacks were assumed

- In the five years from 2016 – 2020, the company will pay out 1816 million dollar as dividends.

In my next post about Hormel I will look more at the price of the whole company.