The german chemical and pharmaceutical company Bayer want’s to buy U.S. agrochemical company Monsanto (link: press release Bayer)

Bayer has made an all-cash offer to acquire all of the issued and outstanding shares of common stock of Monsanto Company for USD 122 per share or an aggregate value of USD 62 billion

Note: The shares are trading at around 110 $, this still would be an upside of roughly 10% now – looks like the market sees some uncertainties. I see the undisturbed price for Monsanto at around 90 – 95$.

Monsanto rejects $62B Bayer bid, but still is open to talks (link)

Monsanto shares closed regular trading up 3.1 percent at $109.30 and gained another 1.5 percent in after-hours trading, rising to $111.

Meanwhile:

That could be a problem, with some saying Bayer’s proposal, at 15.8 times Monsanto’s earnings before interest, tax, depreciation and amortisation (EBITDA) for the year ended Feb. 29, is already a stretch for the German company.

Let’s take a look at what Bayer is planning to pay for 62 bn

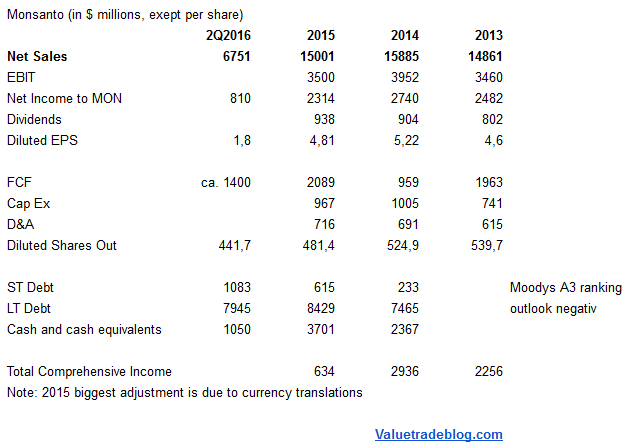

I looked at Monsantos 2015 annual report, which besides some nice photos of families marvel at corn presents us this numbers: (link)

Their 2024 Bond yields 3.24% (link morningstar)

From the 2Q2016 report (link)

Monsanto updated its fiscal year 2016 as-reported EPS guidance to be in the range of $3.72 to $4.48 per share, primarily due to a change in the expected timing for the accounting of restructuring expense. The company confirmed ongoing EPS guidance in the range of $4.40 to $5.10 per share.

Let’s be optimistic and assume that they can reach the $5.10 per share. At a price of 122 USD this would be a PE-ratio of 23.9 – not that cheap.

Bottom Line:

Like in mostly M&A activities this is an interesting case with some uncertainties and some chances. I don’t have deeper insight into this one but I will follow this from the sideline and hopefully will learn something from it. I’m planing to look at Bayer next.

It is a GIGANTIC

LikeLike

Not sure what happened there.

It is a GIGANTIC purchase if it goes through. I think several Govt bodies will be extremely focused on this deal to see if they actually want it to go ahead.

Tristan

LikeLike

Yes it realy is Gigantic. Bayer is not much bigger than Monsanto (still one of the biggest companies in the DAX).

Government interventions are almost always a factor at M&A (see Staples/OfficeDepot). This will be a interesting case.

greetings

LikeLiked by 1 person